What is a Logging vehicle?

6.2k views |

Last modified 5/10/2022 8:31:55 AM EST

A vehicle will be considered a logging vehicle if used exclusively to transport products harvested from a forest site and registered under the state as a heavy motor vehicle used solely to transport products from a forest site. The products harvested from a forest site include timber, charcoal, plywood, veneers, and poles.

Why should you mention a vehicle as a logging vehicle in Form 2290?

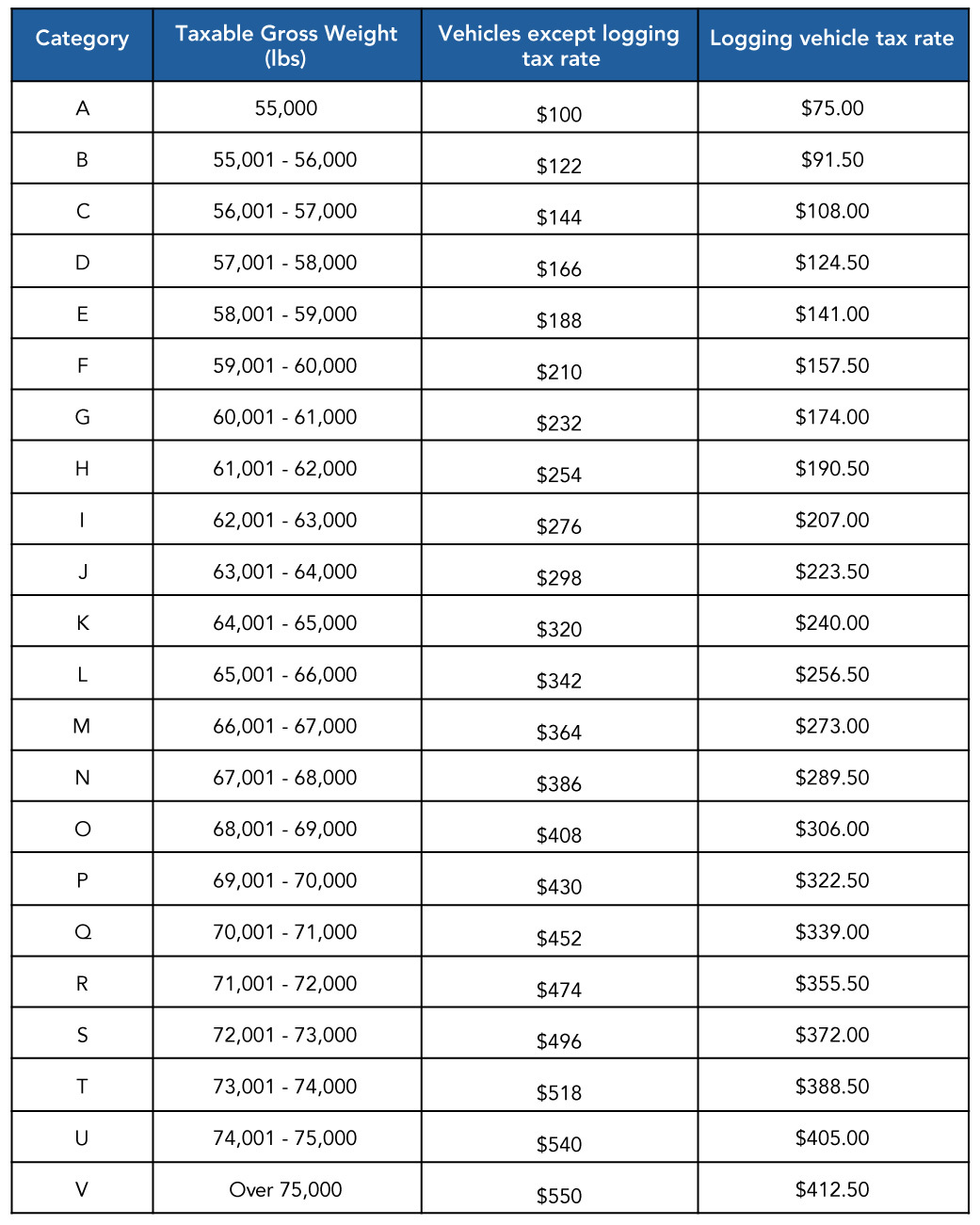

While filing your Form 2290, the HVUT rate for the Logging vehicles is less compared to the other vehicles. So, it is necessary to mention your logging vehicle in Form 2290 if it is exclusively used for transporting forest goods.

Reporting Logging Vehicle on Form 2290 using ExpressTruckTax

ExpressTruckTax is a market-leading e-file provider of Form 2290. Create a free account with ExpressTruckTax and file Form 2290 online today for the 2022-2023 tax period. And, get your stamped Schedule 1 in a few minutes.

- Create a FREE account with ExpressTruckTax and add business details.

- Choose Form 2290 and select FUM & Tax year.

- Make sure that you have checked the Logging Vehicle category under your vehicle details.

- Review and transmit the return to the IRS.

If you have questions regarding the filing of Form 2290, contact our US-based support team via phone, chat, or email. The best part is our support team is bilingual (English & Spanish).