How do I renew a Form 2848?

2.0k views |

Last modified 6/8/2023 4:56:38 AM EST

Form 2848 is a power of attorney return filed by tax professionals for each business they represent, to file tax returns on behalf of their clients.

If the years mentioned in your Form 2848 are over, your power of attorney with that particular business will expire. You must renew your Form 2848 to continue filing for that business. Click here to renew your Form 2848 with the IRS.

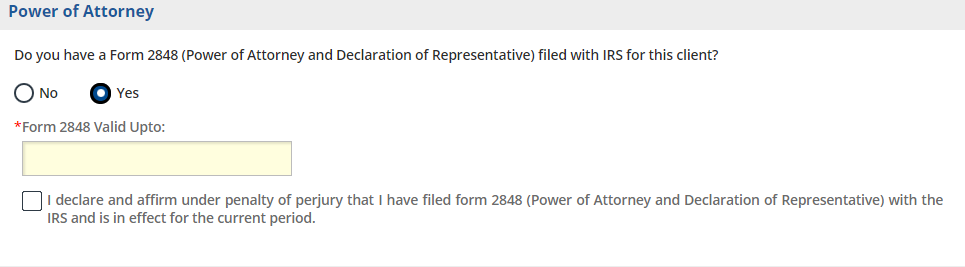

Once you renew your Form 2848, you have to update the new Form 2848 expiry date in ExpressTruckTax to file Form 2290 for your clients with us.

Here's what you have to do to update your Form 2848 expiry date in ExpressTruckTax:

- Log in to your ExpressTruckTax account.

- Select the particular business for which you had filed Form 2848 by using the search tab in the dashboard.

- Click on the Pencil icon against the business information in the dashboard to edit your business information.

- You can now update your new Form 2848 expiry date in the "Power of Attorney" section.

If you did not renew your Form 2848, you can choose "No" as the Power of Attorney and start filing your returns with Form 8453-EX.